Global monetary policy is not tightening as expected

AT ITS outset, 2017 seemed likely to mark a turning-point for global monetary policy. The Federal Reserve had just raised its main interest rate by a quarter-point and was expected to add three such increases this year—or perhaps even more, if a new Republican Congress could agree on tax cuts with a new Republican president. In that case, low interest rates would no longer be the “only game in town” in terms of policy stimulus. The European Central Bank (ECB) would begin to wind down its programme of quantitative easing, or QE, probably by mid-year. The Bank of Japan would cut back on QE, too. In September it set a target yield for ten-year bonds, of 0.0%, which would probably require fewer asset purchases. Of the global giants, only China seemed likely to keep its policy settings as loose as in 2016.

In this context, the ECB’s meeting on June 7th and 8th was not long ago eyed as pivotal. The bank’s staff would produce new, upbeat economic forecasts. Many ECB-watchers (and maybe some of its governing council) reckoned it might signal the “tapering” of QE. That now looks unlikely. Figures this week showed that underlying inflation fell to 0.9% in April, well short of the ECB’s target of below-but-close-to 2%. On May 29th Mario Draghi, the ECB’s boss (pictured), told the European Parliament that the bank was “firmly convinced” that an “extraordinary amount” of monetary support was still needed.

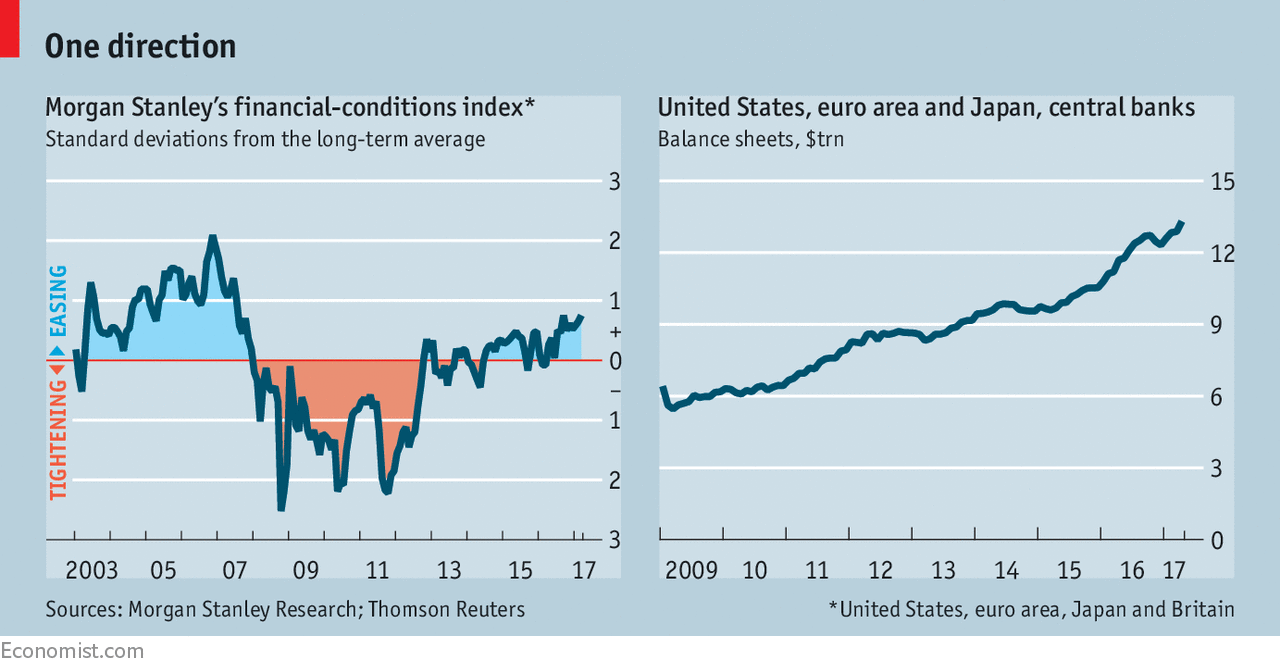

Elsewhere, too, things are not going entirely to plan. The Fed raised interest rates in March and is widely expected to do so again in June. But thereafter markets have priced in little in the way of further increases. And few other central banks are following its lead. Indeed several have cut rates. Mr Draghi’s ECB is not alone in its taper caution. The pace of the Bank of Japan’s purchases has not fallen much. The balance-sheets of these three central banks, in aggregate, are still expanding. They are unlikely to start shrinking until 2019. A broad measure of rich-world monetary conditions compiled by Morgan Stanley, which incorporates short-term interest rates, bond yields, share prices and other variables, suggests that monetary policy is becoming looser, if anything (see chart). The wild card is still China—but in an unexpected way; banks’ borrowing has in fact been squeezed. But even there, the authorities are keen not to go too far.

Central banks are treading carefully in part because of low inflation. Headline rates of inflation have risen this year, but largely because of higher oil prices. Price indices that exclude volatile food and energy costs tell a different story. The underlying rate on the index preferred by the Fed fell to 1.5% in April, for instance. But monetary policy also reflects the specific risks to financial stability in America, Europe and China. The goals of stable inflation and steady finance are not always compatible. For instance, the ECB’s benchmark deposit rate is negative: ie, it charges commercial banks for holding deposits with it. The result is a check on banks’ profits. The ECB’s judgment has been that the positive effect of negative rates on the economy is worth the risks. The Bank of Japan also has a negative deposit rate, but is kinder to banks: its policy of “yield-curve control” ensures that long-term interest rates are higher than short-term ones, which helps banks make profits.

Yet the main risk highlighted in the ECB’s recent Financial Stability Review is a sudden rise in bond yields. A hasty withdrawal of QE could plausibly set off such a change, especially in countries such as Italy with large public-debt burdens. That is one more reason for the ECB to go slow. In contrast, China, where debt has risen from 150% of GDP in 2007 to 280% in 2016, faces a dicier trade-off. It is trying to tackle dangers in the financial system without slowing down the economy unduly. The People’s Bank of China, the central bank, has not raised its benchmark one-year lending rate, currently 4.35%—the way it has tightened monetary policy in the past. Instead, it has been stingier in supplying short-term liquidity to banks. Seven-day interest rates in the volatile interbank market have gone up by about half a percentage point since February, to around 3%. The goal is to restrict funding from China’s big, state-owned banks to so-called “shadow banks” that use the interbank market to finance risky lending.

China’s bank regulator has added to the squeeze. It has clamped down on irregular or complex transactions in the interbank market, and on ruses used by banks to increase leverage. The authorities have tried to limit the potential damage to the economy: by giving banks liquidity for medium-term loans; and through state-directed finance for infrastructure by “policy banks”, such as the China Development Bank. But a broad measure of credit growth has slipped, from around 16% in 2016 to 14.5%, according to Morgan Stanley. It might decline further, to 13%, by the end of the year. GDP growth will also slow.

The Fed faces no such conflict. It is raising interest rates for standard reasons: to head off excessive inflation. Financial risks are quite low down its list of worries. In a speech on May 30th, Lael Brainard, a member of the Fed’s board of governors, noted mild concern about the car-loan market and corporate debt. But in general, finance was stable, she said. House prices are aligned with rents, in contrast to the mid-2000s; stockmarkets are dear but less so than in the late 1990s. Her main concern was not that equity prices are frothy but that weak inflation might persist. She noted that the underlying rate is falling and wage growth is not picking up, despite lower unemployment.

Though most market participants expect the Fed to increase the target range on its main interest rate on June 16th by another quarter-point to 1-1.25%, the markets are pricing in very little beyond that. Investors are betting that the federal-funds rate will be just 1.5% at the end of 2018. If the Fed lives up to the median forecast of its rate-setting committee, the rate by then should be 2.25%. But sluggish inflation may well force a rethink. In any event, the Fed has prepared the ground for a reduction in its balance-sheet, to begin soon. As things stand, the Fed reinvests the proceeds of maturing bonds, but the plan is to allow a fixed amount of those to run off. Initially the cap would be set at a low level (as little as $12bn a month on one reckoning) and would gradually increase every quarter. Economists at JPMorgan Chase reckon that shrinking the Fed’s balance-sheet by $1.5trn would eventually push up ten-year yields by 0.25%. But the Fed is likely to move so slowly that the effect will be barely perceptible. Since the plans were outlined, the yield on ten-year Treasuries continued to fall, reaching 2.2%, down from a recent peak of 2.6% in March.

In large part, falling bond yields reflect a growing conviction that short-term interest rates are unlikely to rise quickly or soon. Central banks are fearful of cutting short the synchronised global economic upswing and, with inflation quiescent, see no real need to take the risk. They are buying lots of assets: the ECB and Bank of Japan are acquiring more; the Fed is still reinvesting. In short, little is afoot to upset the bull-market mood: “They’ve still got your back”, is the message that investors are taking from central banks, says David Riley, of BlueBay Asset Management. Global stockmarkets are buoyant. The cost of short- and long-term borrowing remains low by any standards. The dollar has retreated. In the broadest terms, financial conditions are easy. The global upswing is still receiving plenty of support from central banks. An extraordinary amount, in fact.